RightRev

RightRev’s automated revenue recognition frees your accounting team from manual work.

Overview

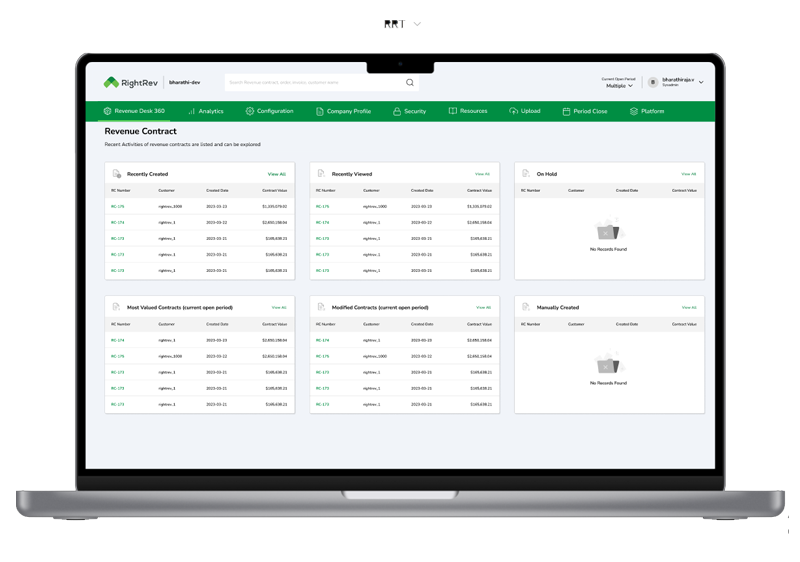

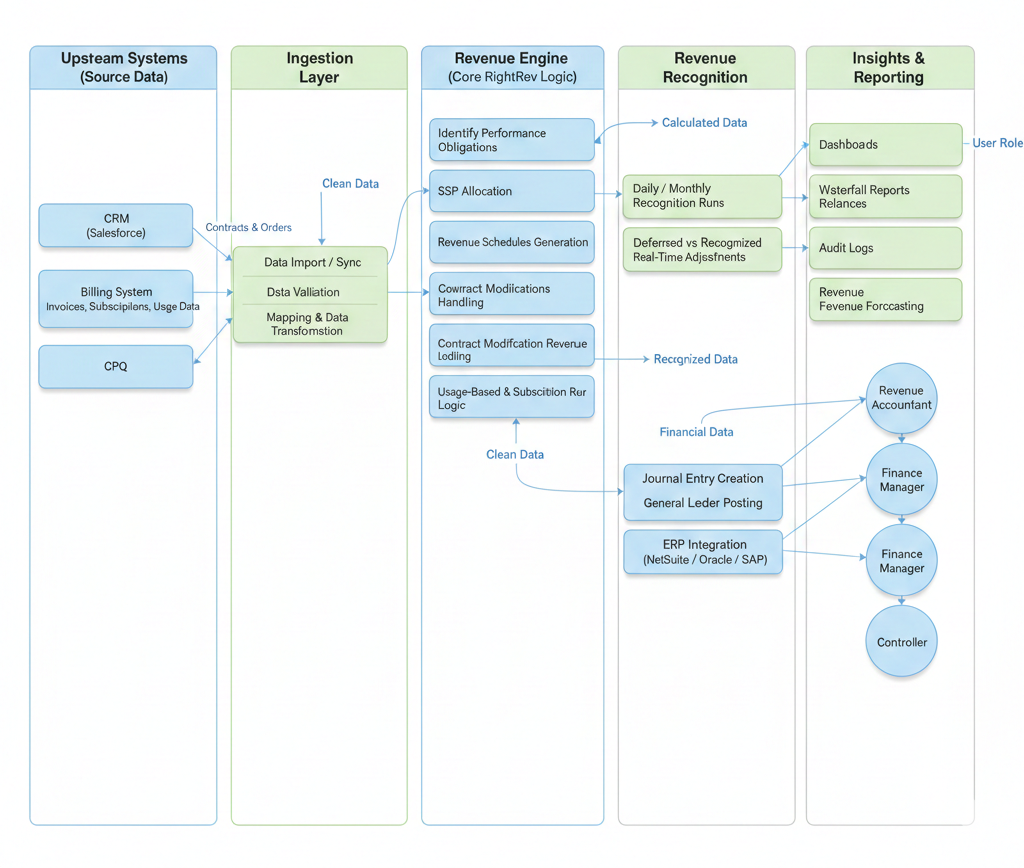

RightRev is a cloud-based revenue recognition platform designed to automate the entire

revenue lifecycle

for subscription, usage-based, and hybrid business models. It ensures accurate, compliant,

and audit-ready

revenue processes aligned with ASC 606 and IFRS 15 standards.

The platform empowers finance teams by replacing manual spreadsheets with intelligent

automation, real-time

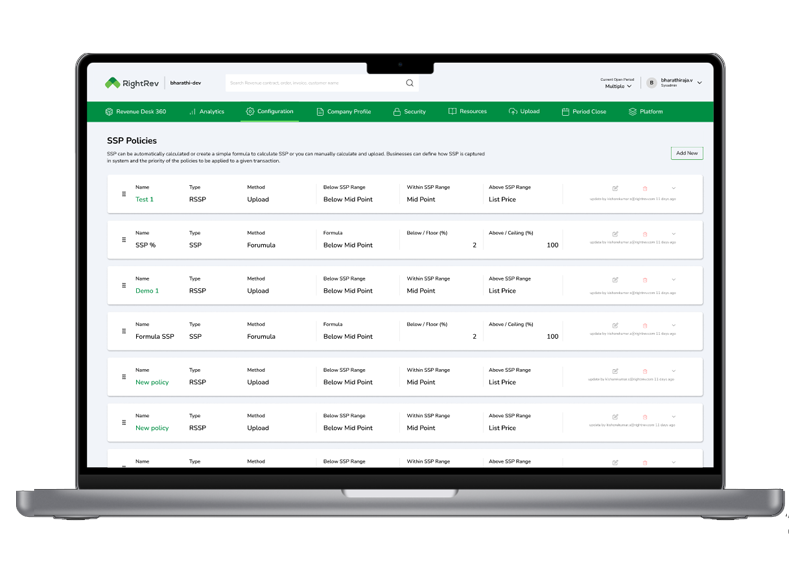

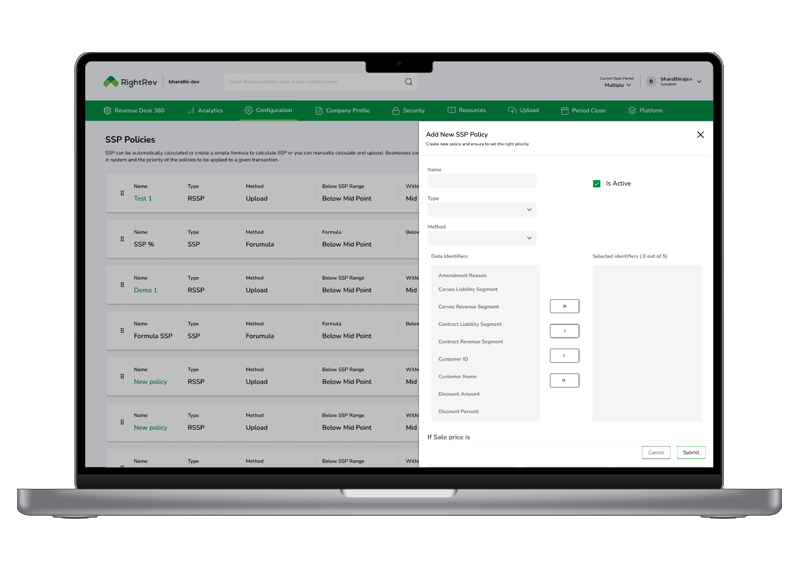

dashboards, configurable revenue rules, SSP allocations, contract modification handling, and

detailed

reporting. As the lead designer from the project’s inception, I shaped a unified SaaS

experience that

simplifies complex financial operations through intuitive workflows, modern UI patterns, and

a scalable

design system.

My Role

As the Lead Product Designer for RightRev, I was responsible for shaping the end-to-end user

experience

from the very first day of the project. My work covered the complete design ecosystem

including

dashboards, revenue modules, reporting, analytics, configuration flows, company profile, and

accounting integrations.

I owned the design strategy, information architecture, wireframes, high-fidelity UI,

interaction models,

design system creation, and cross-functional collaboration with product managers, engineers,

finance experts,

and QA teams to bring the product to life.

- End-to-end UX/UI design ownership

- Information Architecture & Navigation Design

- Wireframes, High-Fidelity UI & Interaction Design

- Design System & Component Library

- Workflow design for complex accounting scenarios

- Collaboration with Product, Engineering & Finance SMEs

The Challenge

Designing for a revenue recognition platform involves navigating complex financial logic, compliance standards, multi-element contracts, usage-based pricing, and large-volume data processing. The biggest challenge was simplifying deep accounting workflows while maintaining complete transparency, accuracy, and audit readiness.

- Translating complex accounting logic into intuitive workflows

- Designing clear dashboards for high-volume financial data

- Ensuring transparency for ASC 606 / IFRS 15 compliance

- Supporting multiple revenue models (subscription, usage, hybrid)

- Maintaining consistency across modules and configurations

- Improving usability for finance teams accustomed to Excel

Objectives

- Create a unified and intuitive SaaS experience

- Reduce cognitive load for finance and accounting users

- Design data-heavy dashboards with clear visual hierarchy

- Support flexible revenue rules, SSP allocations, and contract modifications

- Ensure every module follows a consistent design system

- Improve traceability and audit visibility across workflows

- Optimize user flows for high-volume transaction processing

Target Users

- Finance Teams & Revenue Accountants

- Controllers & Accounting Managers

- CFOs and Financial Analysts

- RevOps and Billing Teams

- Enterprises using subscription, usage, or hybrid pricing

- Companies transitioning from manual spreadsheets to automation

UX Insights

Our research and collaboration with finance teams revealed key UX patterns required for accurate and efficient revenue management. These insights shaped how data, workflows, and actions were organized across modules.

- Users need complete visibility into revenue allocation and recognition logic

- Simplicity is essential—finance users prefer clarity over visual complexity

- Progressive disclosure helps reduce overload in data-heavy screens

- Familiar, spreadsheet-friendly table patterns increase adoption

- Performance matters; large datasets require optimized layouts

- Audit logs and traceability increase user trust in automation

Revenue Recognition Platform Case Study

Designing a scalable, compliant, and intuitive SaaS experience for complex revenue operations.

Impact

The redesigned RightRev experience delivered significant improvements in clarity, usability, and operational efficiency for finance teams. By transforming complex revenue workflows into intuitive interfaces, the product increased trust, transparency, and overall adoption.

- Faster onboarding for new finance and accounting users

- Increased accuracy and reduced manual revenue calculation errors

- Significant reduction in audit preparation time

- Improved visibility into deferred and recognized revenue

- Consistent design system enabling faster feature delivery

- Higher trust and adoption due to transparent data flows